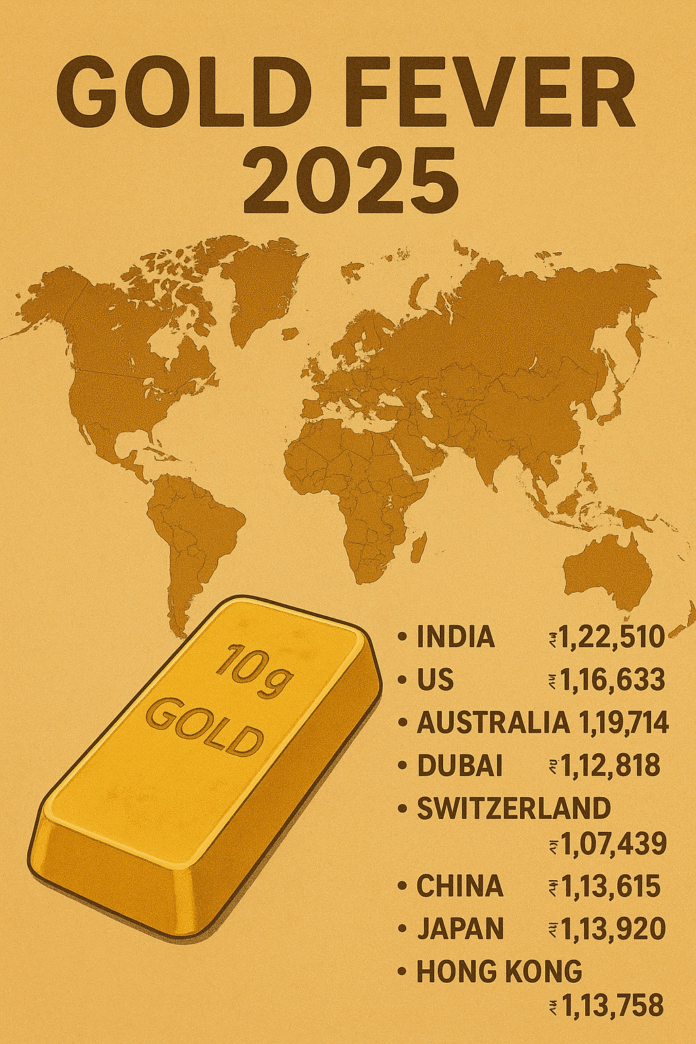

They say gold has no borders but your wallet might disagree. In 2025, the price of 10 grams of gold paints a glittering picture of global economics, with each country revealing its own shade of sparkle.

At the very top of the golden ladder sits India, where 10 grams now cost a dazzling ₹1,22,510 making it one of the most expensive places in the world to buy the yellow metal. Despite high prices, Indian demand hasn’t dimmed; weddings, festivals, and family heirlooms continue to keep jewellers busier than ever.

Just behind is the United States at ₹1,16,633, proving that even in a dollar-driven economy, gold remains the ultimate hedge against uncertainty. Australia follows closely at ₹1,19,714, where investors are treating gold as both glamour and guarantee.

Across the Middle East, Dubai once the go-to destination for gold shoppers now lists its price at ₹1,12,818, still competitive but no longer dramatically cheaper than its global peers. Meanwhile, Switzerland, the world’s luxury hub, surprisingly offers one of the lowest rates at ₹1,07,439, thanks to its stable currency and refined bullion market.

Asian markets like China (₹1,13,615), Japan (₹1,13,920), and Hong Kong (₹1,13,758) show remarkable price parity, reflecting both regional demand and strong currency management.

So what’s driving these glittering gaps? Exchange rates, import duties, local taxes, and inflation all play their part. But beyond numbers, gold’s allure is emotional, a symbol of stability when everything else feels uncertain.

Whether it’s an Indian bride, an American investor, or a Swiss banker, 2025 proves one thing: gold is not just a metal.

It’s a mirror reflecting culture, confidence, and the timeless human urge to hold a little piece of forever.