No matter how long you have been in the world of fintech, blockchain, or even DeFi, we are sure that you have heard of the term CFD shares. And you are probably here because you want to understand more about them. This includes what they are, how to trade them, and more.

Well, first note that these are instruments that offer you a smart method to gain exposure to technology-driven markets. Therefore, they are not just another financial product. We can refer to them as a link between conventional stocks and cutting-edge resources such as digital asset exchanges and Web3-based trading platforms.

Allow us to dive deeper into CFD shares to help you understand exactly what they are.

CFD Shares Explained

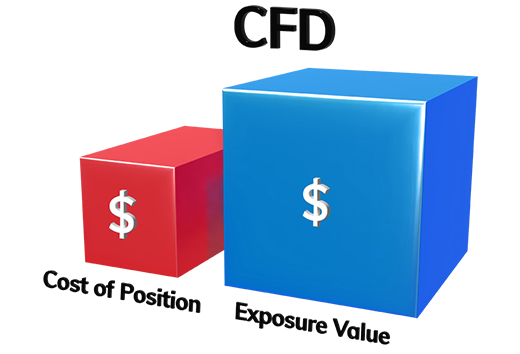

Have you ever wondered what CFD shares are? To put it simply, these are agreements that allow you to trade on changes in the value of stock without really holding any. To profit from changes in the stock’s price, you don’t have to own it.

These days, you may trade CFD for stocks on user-friendly platforms driven by AI and blockchain. Isn’t it incredible how trading has become easier and safer for you thanks to modern technology?

The Smart Way to Trade CFDs

Knowing the fundamentals is the first step in how to trade CFDs. You open a transaction after selecting a share that you believe will rise or fall. You profit from the price change if your guess is correct. If it’s incorrect, you lose money. The good news is that tools like price notifications, automatic analysis, and even DeFi features on contemporary platforms make how to trade CFD simpler.

Now, let us use this CFD trading example. You invest in a popular tech stock, such as one from a blockchain-based business. You go ahead and open a CFD position rather than purchasing the shares. If the price increases, you profit from the rise. And you lose if it falls. In this manner, you can access fascinating sectors without really holding stock.

Frequent Trading on a CFD Account

Sometimes, you might wonder, can you frequently trade on CFD accounts? You can but only if you have a well-defined plan. Thanks to current apps and Web3 tools, trading has grown faster and smarter.

However, it can be dangerous to dive in without guidance. Blockchain data, AI, and machine learning are used by profitable traders to monitor market movements. In this manner, you can make decisions based on factual information rather than your feelings.

How Web3 and Fintech Are Linked to CFD Shares

CFD shares are well suited to the rapidly evolving fintech and Web3 landscape. Unlike the usual technique of buying stocks, which frequently demands more money and time, CFDs let you trade on market fluctuations nearly instantly. You now benefit from increased security, transparent records, and speedier transactions when blockchain technology is included.

Isn’t that what all contemporary investors desire? This combination seems thrilling to anyone who is enthusiastic about Web3 because it combines the new potential of digital innovation with the well-known concept of stock trading.

Conclusion

Sometimes, stock trading may seem complex. But with technology making everything easier to understand, you can enter the market with confidence. Do not forget that planning and having patience as well as using technology to optimize your gains are important also.