The proposed India–European Union Free Trade Agreement (FTA) is being described as the “Mother of All Deals” due to its sheer economic scale and strategic significance. The European Union is the world’s largest trade bloc, while India is one of the fastest-growing major economies. Together, the agreement is expected to create a shared market of nearly two billion people, accounting for around 25% of global GDP.

At a time when global supply chains are looking for alternatives to excessive dependence on the US and China, the India-EU FTA could emerge as a game-changing economic partnership, positioning India as a key manufacturing and export hub for Europe.

India-EU Trade: The Big Picture

India-EU bilateral trade stood at approximately ₹12.5 trillion last year. Following the FTA, trade volumes are expected to double in the medium term, as both sides gain easier access to each other’s markets through reduced tariffs and simplified regulations.

Key Benefits for India

- Boost to labour-intensive sectors: Import duties of up to 10% on Indian textiles, garments, leather, footwear, gems and jewellery could be reduced or eliminated, significantly improving exports to Europe.

- Defence manufacturing push: European countries such as France and Germany may set up defence production units in India, providing Indian companies access to EU defence funds and technology.

- Pharma and chemicals growth: Trade in pharmaceuticals and chemicals could grow 20–30% annually, as regulatory approvals and compliance procedures are streamlined.

- Relief from EU carbon tax: India is expected to receive concessions under Europe’s carbon border tax mechanism, benefiting sectors such as steel, aluminium and green hydrogen.

- Lower-cost imports: European wines, cars and industrial goods could become cheaper in India due to reduced import duties.

What Europe Gains

- Reduced duties on wines and spirits, making European alcoholic beverages more affordable in India.

- Better access for premium carmakers such as BMW, Mercedes and Porsche. Currently, imported cars face taxes of up to 110%, which could drop to 40% initially and eventually to around 10%.

- India has agreed to immediate tariff reductions on certain European cars priced above €15,000.

- Expanded opportunities for European firms in IT, engineering, telecom and business services.

India: A Key Auto Market

India is now the world’s third-largest automobile market, yet foreign brands account for less than 4% market share, largely due to high taxes. Lower duties would allow global automakers to introduce more models, test demand, and potentially make long-term manufacturing investments in India.

Potential Challenges

For India:

- Domestic alcohol and automobile manufacturers may face intense competition.

- Compliance with Europe’s strict environmental, labour and carbon norms could raise costs for Indian exporters.

- Tighter patent rules could increase prices of some essential medicines.

- Small and medium enterprises may struggle against large European firms.

For the EU:

- Influx of low-cost Indian goods could pressure local industries.

- European firms will need to adapt to India’s regulatory and market conditions.

- Greater mobility for Indian professionals could raise job-market concerns in some EU states.

- Reduced reliance on China will require internal supply-chain adjustments.

Key Sectors Excluded

Sensitive areas such as agriculture and dairy have been excluded from the FTA. India fears that European farm products could impact domestic farmers, while the EU is equally cautious about protecting its own agricultural sector.

Beyond Trade

Apart from the FTA, India and the EU are negotiating agreements on investment protection, GI tags, defence cooperation, labour mobility and strategic security partnerships.

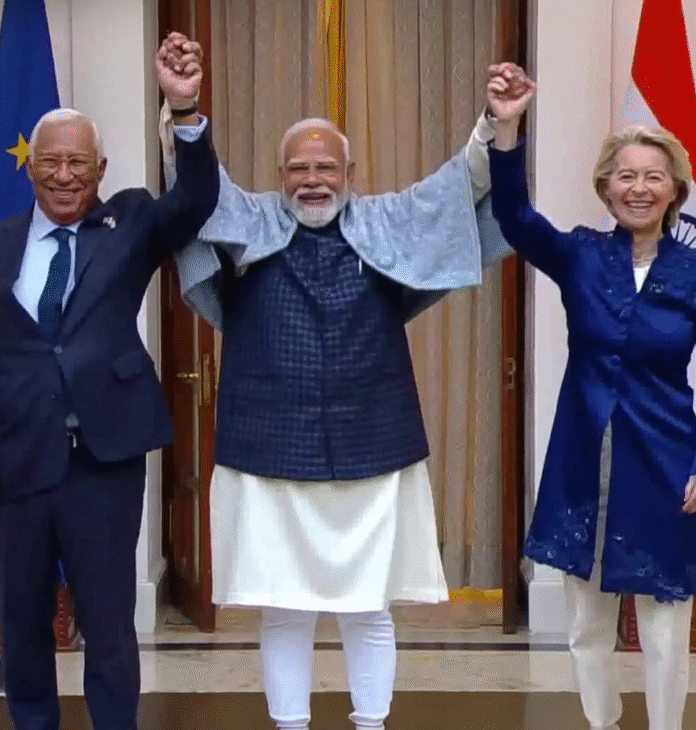

European Commission President Ursula von der Leyen has termed the agreement historic, stating that “a successful India makes the world more stable, secure and prosperous.” She emphasised that the deal would create one of the largest integrated markets in the world, covering nearly a quarter of global GDP.